Thank you to everyone that joined us at the 2nd Annual Healthcare Payment & Revenue Integrity Congress West in Las Vegas!

Where healthcare leaders come to increase savings, share strategies, foster collaboration and discover innovative solutions. This event unites health plans, healthcare providers, and vendors, creating a community to tackle challenges along the claims continuum and identify cost containment opportunities.

Missed out on Vegas?

WHY HPRI

DON'T TAKE OUR WORD FOR IT

It's a unique forum that brings together providers, payors, vendors and regulators for collaboration, education and information sharing.

I learned so much at this event from the top experts in the field! This event also made me think of new and innovative ideas from listening to all of the various speakers

It was a great opportunity to connect with others whom are passionate about providing excellent service and resources to organizations whom want to be transformative and innovative in the world of Payment Integrity.

It was a great opportunity to hear from many subject matter experts over a wide topic of subjects specific to Payment/Revenue Integrity.

This conference filled the much needed gap in focusing on Payment Integrity issues and initiatives

This was the most meaningful industry event of the year for Payment Integrity professionals

I learned so much from this event and met so many new connections. It was wonderful to hear different perspectives and learn about new opportunities!

26% of health plans identify access to quality data as their biggest challenge

Understand the several critical points for payers in the healthcare sector as they navigate the complexities and opportunities of 2024 considering the evolution of payment integrity, opportunities with AI implementation and impact of financial pressures.

-

"The HPRI event's are great. I enjoy the presentations, opportunity to meet with vendors and network with other payers and providers."Monique Pierce, Head of Payment Integrity joined Devoted Health in 2020 with the goal of building the first ever integrated Payment Integrity Program. She shares her experiences, wins and challenges at the HPRI events.

"The HPRI event's are great. I enjoy the presentations, opportunity to meet with vendors and network with other payers and providers."Monique Pierce, Head of Payment Integrity joined Devoted Health in 2020 with the goal of building the first ever integrated Payment Integrity Program. She shares her experiences, wins and challenges at the HPRI events. -

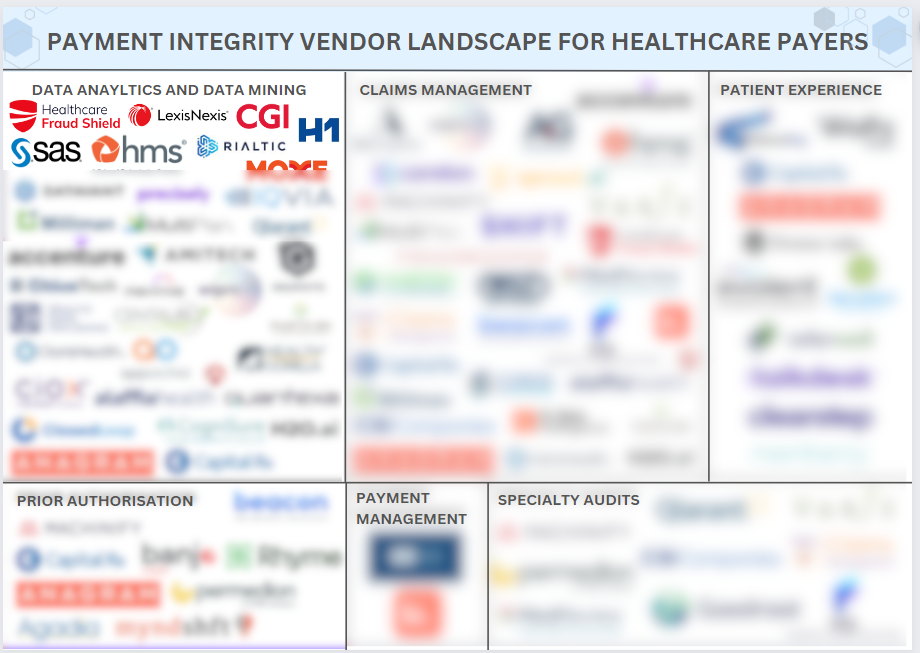

Navigating the Payment Integrity Vendor landscape with usThe ultimate guide to who’s who in the payment integrity vendor space – to help you choose the best option for your business.

Navigating the Payment Integrity Vendor landscape with usThe ultimate guide to who’s who in the payment integrity vendor space – to help you choose the best option for your business. -

Looking for tips and tricks on how to develop your payment integrity strategy in 2024?We met with leader Dr. Michael Seavers from Harrisburg University of Science and Technology on where to start when it comes to addressing your current strategy to ensure you are working efficiently.

Looking for tips and tricks on how to develop your payment integrity strategy in 2024?We met with leader Dr. Michael Seavers from Harrisburg University of Science and Technology on where to start when it comes to addressing your current strategy to ensure you are working efficiently.

The Payment Integrity Vendor Landscape

Navigating the Payment Integrity Vendor landscape can be daunting for health plans and providers, given the multitude of vendors and their diverse specialties. With so many options available, it's often difficult to identify the best partners. That's why we've created this document, which showcases the top vendors tailored to your specific needs including:

- Fraud Anayltics

- Provider Networking/Contracting

- PI BPO

- Pharmacy Benefit Management

- Coordination of Benefits

- Subrogration

- Risk Adjustment/Analytics

- Data Analytics and Data Mining

- Claims Management

- Patient Experience

- Specialty Audits

- Prior Authorisation

- Payment Management

OUR COMMUNITY OF PAYERS AND PROVIDERS

How To Get Involved

Demonstrate your tech and leadership by partnering with us

Partner with us to elevate your brand and make valuable connections. Opportunities for thought leadership, branding, and networking available. Contact Harry Ludbrook at [email protected].

Healthcare Payers and Providers attend for free

Join interactive discussions and presentations on key challenges and opportunities presented by payment companies. All payers and providers qualify for complimentary passes.

PREVIOUS SPEAKERS

Darren Wethers

Darren Wethers is a board-certified internal medicine physician and certified physician executive.

He graduated from Morehouse College, Northwestern University Medical School and completed internal medicine training at Emory University School of Medicine before establishing an internal medicine practice in the St. Louis, Missouri area, becoming a “Top Doctor” Honorée several years running. Dr. Wethers was the medical staff president at SSM St. Mary’s Health Center in 2006-07 and chaired the facility’s Credentials committee 2007-11.

In 2011, Dr. Wethers began a career in administrative medicine, servings as a medical director with Coventry Health Care and Aetna, vice president of clinical operations at Blue Cross Blue Shield of Arizona and is now at Atrio Health Plans, where he serves as chief medical officer.

Dr. Wethers is a member of the American Association for Physician Leadership, Fellow of the American College of Physicians, member of Alpha Phi Alpha and Sigma Pi Phi fraternities; he is a board member and immediate past chairman for Gamma Mu Educational Services (GMES) and is a board member of Northwestern University Medical School Alumni Association, for which he serves as president-elect and co-chair of the Inclusion and Allyship committee.

Jonique Dietzen

With over 18 years of experience in healthcare billing and finance, I am a certified professional coder dedicated to ensuring accurate claims and proper reimbursement for providers. Having worked extensively on the provider side in finance and revenue cycle, I bring wealth of knowledge to the table, particularly in processing and payment integrity.

Throughout my career, I have gained a comprehensive understanding of billing challenges from both perspectives. This unique insight drives my commitment to improving billing practices and advocating for provider education. I continue to leverage my expertise to enhance billing processes and support providers in navigating the complexities of healthcare finance.

Helen Liu, Pharm.D.

Dr. Liu is the Vice President of Pharmacy Operations for the ATRIO Health Plans, where she manages and oversees all Part D-related operations. Dr Liu has an extensive background in clinical pharmacy, medication safety, managed care, and data outcome analysis. Before this role, she developed and implemented the inpatient Drug Use Management program at Kaiser Permanente.

Josh Miller

Michael Devine

Stephanie Sjogren

Stephanie Sjogren is a director of coding and provider reimbursement, working with payment integrity to ensure proper claims adjudication and to prevent fraud, waste, and abuse. Prior to joining ConnectiCare/EmblemHealth, she performed provider audits and education at a women’s healthcare group. Sjogren has also worked with physicians and staff to integrate and use electronic health record systems effectively and to stay in compliance with the Centers for Medicare & Medicaid Services’ rules and regulations. Her areas of specialty are payment integrity, auditing, and clinical documentation improvement.

AGENDA HIGHLIGHTS

Panel: Strengthening Payer and Provider Relationships

- A discussion focused on strengthening ties and reducing provider abrasion

- Case studies of successful payer-provider initiatives and effective provider engagement strategies

- Progressing mutually beneficial initiatives in a collaborative manner

Janell Zuckerman

Janell Zuckerman has been at Select Health since 2021 as the Provider Network Development Director for Idaho. She leads the strategy and operations for network development including provider relations, contracting, and performance. Her focus is on building partnerships with regional clinically integrated networks and hospitals, and improving interaction models between payers and providers. She has successfully developed a direct Select Health network in Idaho and new clinically integrated network agreement, with new product launches across Southern Idaho for commercial and Medicare lines of business.

Janell has 15 years of experience in areas of acute care and ambulatory operations, clinically integrated networks, value-based care, and public health and policy, with time at St. Luke’s Health System and the YMCA. In 2023 she was an Idaho Business Review’s Women of the Year honoree. She is a board member and vocal artist with Opera Idaho and association member with HFMA and ACHE. She is a purpose-driven leader and serves as a connector across the health care ecosystem.

Janell is an Idaho native and lives with her husband and two children in Boise, Idaho. She holds a B.A. in English from Tufts University and Masters in Health Administration from Ohio University.

Stina Redford

Payment Integrity Protecting Your Healthcare Dollar, Recent Schemes and Trends

- Payment Integrity Begins at the Top

- The SIU’s Greatest Need-Data

- Recent Schemes & Trends

- Internet Based Providers

- Behavioral Health Providers

- Telehealth Providers

Carl Reinhardt

Revenue and Value Analysis Teams Collaborating to Achieve Decrease Cost

- In healthcare to optimize skills, understanding, and expertise used to improve the value of products, it is essential to remove clinical and financial silos. Collaborating and aligning revenue teams with value analysis teams provide a platform to tell the entire business story in healthcare, decrease cost, and increase revenue.

- Relationships in this arena generate opportunities to find billing and charging errors, and implement best practices into workflow, procedures, and buying trends. Collaboration benefits the teams by offering vital evidence that helps providers make judicious choices about the products they may want to bring into facilities. A revenue cycle analyst can aid in the discovery of problems with processes or old ways of how and where procedures are performed. Using dashboards, reports, and charging and reimbursement data can be seamlessly be integrated into existing value analysis processes making it easy to collaborate on the best ways to achieve your revenue targets.

Lori Jensen

MEDIA KIT

For more information on webinars, roundtables, content marketing packages, interviews and marketing solutions opportunities, download the Media Kit.

If you have any questions, please contact Harry Ludbrook, Sales Director, [email protected].

OUR COMMUNITY

Step into interactive discussions and engaging presentations on the key challenges and opportunities presented by payment companies today:

OUR PARTNERS

AUDIENCE BREAKDOWN

-

Healthcare Payers/ Insurance Companies40%

-

Healthcare Providers30%

-

Payment Integrity Vendors30%

OUR SELECTION COMITTEE

Brannon Morisoli

Mr. Morisoli joined SWK Holdings as a Senior Analyst in March 2016. Prior to joining SWK, he was an Investment Analyst and Portfolio Manager for a family office that invested in equities, fixed income, real estate, and alternative investments. Prior to that, he was an Investment Analyst for Presidium Group, a real estate private equity firm, where he played an integral role in closing over $100mm in transactions. Mr. Morisoli began his career at Neurografix, a startup medical technology company in Santa Monica, CA that was doing groundbreaking work in the MRI imaging of peripheral nerves. While with Neurografix, he was published in two leading neurology journals. Brannon graduated from UCLA with a B.S., was awarded a fellowship and graduated from the University of Notre Dame with an M.B.A, and was awarded a Samson Fellowship from the University of Wisconsin Law School, where he graduated with a J.D. Mr. Morisoli is an inactive member of the State Bar of Wisconsin

Thomas Busby

Thomas Busby is a Vice President and has been with Outcome Capital since 2015. He focuses on medical technology, digital health and life science services segments with particular interest in innovative life science companies that deliver patient impact by leveraging novel approaches. Thomas is driven by the desire to identify disruptive technologies and services that require unique strategic thought and assistance to realize their full market potential. Thomas has been published in leading life science journals Life Science Leader and The Pharma Letter, and also serves on the board of HealthTech Build, a Boston-based digital health innovation group.

Prior to his career in life-science investment banking, Thomas pursued his passion for the public service and non-profit sectors working in a variety of leadership and management positions, and at one time held a Massachusetts teaching license.

Thomas completed his MBA at Suffolk University’s Sawyer Business School on full academic scholarship where he was President of the school’s Graduate Business Association and class speaker at graduation. Prior, he completed a BS in Philosophy with Honors from Suffolk’s College of Arts & Sciences. Committed to giving back, Thomas is currently the President of the College of Arts & Sciences Alumni Board of Directors. Thomas is a FINRA Registered Securities Representative holding his Series 79 and 63.

Robert Crousore

Robert has 28 years of experience in the health care products and

services industry. Crousore is a serial entrepreneur with multiple

successful product and services company exits. His experience spans

the entire business enterprise including Sales, Marketing, Operations,

Product Innovation and, most recently M & A.

Highlights Include:

- Has successfully managed a global commercial organization in the wound care business.

- Has a number of patent credits for products in the wound care industry.

- Sits on multiple boards of healthcare technology companies.

- His passion is creating meaningful changes in patient care by combining great products with great teams that are focused on empowering improved clinical and financial outcomes.

Brannon Morisoli

Mr. Morisoli joined SWK Holdings as a Senior Analyst in March 2016. Prior to joining SWK, he was an Investment Analyst and Portfolio Manager for a family office that invested in equities, fixed income, real estate, and alternative investments. Prior to that, he was an Investment Analyst for Presidium Group, a real estate private equity firm, where he played an integral role in closing over $100mm in transactions. Mr. Morisoli began his career at Neurografix, a startup medical technology company in Santa Monica, CA that was doing groundbreaking work in the MRI imaging of peripheral nerves. While with Neurografix, he was published in two leading neurology journals. Brannon graduated from UCLA with a B.S., was awarded a fellowship and graduated from the University of Notre Dame with an M.B.A, and was awarded a Samson Fellowship from the University of Wisconsin Law School, where he graduated with a J.D. Mr. Morisoli is an inactive member of the State Bar of Wisconsin

Thomas Busby

Thomas Busby is a Vice President and has been with Outcome Capital since 2015. He focuses on medical technology, digital health and life science services segments with particular interest in innovative life science companies that deliver patient impact by leveraging novel approaches. Thomas is driven by the desire to identify disruptive technologies and services that require unique strategic thought and assistance to realize their full market potential. Thomas has been published in leading life science journals Life Science Leader and The Pharma Letter, and also serves on the board of HealthTech Build, a Boston-based digital health innovation group.

Prior to his career in life-science investment banking, Thomas pursued his passion for the public service and non-profit sectors working in a variety of leadership and management positions, and at one time held a Massachusetts teaching license.

Thomas completed his MBA at Suffolk University’s Sawyer Business School on full academic scholarship where he was President of the school’s Graduate Business Association and class speaker at graduation. Prior, he completed a BS in Philosophy with Honors from Suffolk’s College of Arts & Sciences. Committed to giving back, Thomas is currently the President of the College of Arts & Sciences Alumni Board of Directors. Thomas is a FINRA Registered Securities Representative holding his Series 79 and 63.

Robert Crousore

Robert has 28 years of experience in the health care products and

services industry. Crousore is a serial entrepreneur with multiple

successful product and services company exits. His experience spans

the entire business enterprise including Sales, Marketing, Operations,

Product Innovation and, most recently M & A.

Highlights Include:

- Has successfully managed a global commercial organization in the wound care business.

- Has a number of patent credits for products in the wound care industry.

- Sits on multiple boards of healthcare technology companies.

- His passion is creating meaningful changes in patient care by combining great products with great teams that are focused on empowering improved clinical and financial outcomes.

PREVIOUS INDUSTRY LEADING SPEAKERS

Darren Wethers

Darren Wethers is a board-certified internal medicine physician and certified physician executive.

He graduated from Morehouse College, Northwestern University Medical School and completed internal medicine training at Emory University School of Medicine before establishing an internal medicine practice in the St. Louis, Missouri area, becoming a “Top Doctor” Honorée several years running. Dr. Wethers was the medical staff president at SSM St. Mary’s Health Center in 2006-07 and chaired the facility’s Credentials committee 2007-11.

In 2011, Dr. Wethers began a career in administrative medicine, servings as a medical director with Coventry Health Care and Aetna, vice president of clinical operations at Blue Cross Blue Shield of Arizona and is now at Atrio Health Plans, where he serves as chief medical officer.

Dr. Wethers is a member of the American Association for Physician Leadership, Fellow of the American College of Physicians, member of Alpha Phi Alpha and Sigma Pi Phi fraternities; he is a board member and immediate past chairman for Gamma Mu Educational Services (GMES) and is a board member of Northwestern University Medical School Alumni Association, for which he serves as president-elect and co-chair of the Inclusion and Allyship committee.

Jonique Dietzen

With over 18 years of experience in healthcare billing and finance, I am a certified professional coder dedicated to ensuring accurate claims and proper reimbursement for providers. Having worked extensively on the provider side in finance and revenue cycle, I bring wealth of knowledge to the table, particularly in processing and payment integrity.

Throughout my career, I have gained a comprehensive understanding of billing challenges from both perspectives. This unique insight drives my commitment to improving billing practices and advocating for provider education. I continue to leverage my expertise to enhance billing processes and support providers in navigating the complexities of healthcare finance.

Helen Liu, Pharm.D.

Dr. Liu is the Vice President of Pharmacy Operations for the ATRIO Health Plans, where she manages and oversees all Part D-related operations. Dr Liu has an extensive background in clinical pharmacy, medication safety, managed care, and data outcome analysis. Before this role, she developed and implemented the inpatient Drug Use Management program at Kaiser Permanente.

Josh Miller

Michael Devine

Stephanie Sjogren

Stephanie Sjogren is a director of coding and provider reimbursement, working with payment integrity to ensure proper claims adjudication and to prevent fraud, waste, and abuse. Prior to joining ConnectiCare/EmblemHealth, she performed provider audits and education at a women’s healthcare group. Sjogren has also worked with physicians and staff to integrate and use electronic health record systems effectively and to stay in compliance with the Centers for Medicare & Medicaid Services’ rules and regulations. Her areas of specialty are payment integrity, auditing, and clinical documentation improvement.

Erik Carter-Nadeau

With over a decade in healthcare leadership, I am passionate about fostering provider engagement and delivering strategic support to improve the health of Oregonians, particularly in rural and underserved areas. As a native Oregonian, growing up in these communities across my state has provided me with unique insights into the cultural and geographic factors that influence healthcare delivery. I am committed to leveraging this understanding to enhance quality, access, and equity in healthcare for all Oregonians.

Eric Renteria

CJ Wolf

Jennifer Callahan

Jen Callahan is the President and Chief Operating Officer of ATRIO Health Plans. For over 20 years, Jen has established herself as a trusted thought leader who helped shape the managed care industry with her innovative ideas and expertise. Jen has dedicated her career almost exclusively to Medicare Advantage and Medicare Supplement programs.

Prior to joining ATRIO, she co-founded a field management organization, Keen Insurance Services, Inc. to create a provider-centric Medicare focused sales and distribution organization from the ground up. Prior to that, she held the position of Vice President, Medicare Product at Aetna, a CVS Health company where she oversaw the product development and implementation of Aetna’s entire Medicare portfolio supporting record breaking growth for the Medicare organization. Throughout her career, Jen has also held various leadership positions at Healthfirst and Elevance.

Jen received her Bachelor of Science degree from Fordham University and MBA from North Carolina State University. Jen currently resides in Waxhaw, a suburb of Charlotte, North Carolina with her husband, their three kids, tuxedo cat, Vivi and golden retriever puppy, Steve.

Zeeshan Syed

Zeeshan serves as Health at Scale’s CEO and was a Clinical Associate Professor at Stanford Medicine and an Associate Professor with Tenure in Computer Science at the University of Michigan. He was previously part of the early stage team that launched Google[X] Life Sciences (now Verily). Zeeshan is a recipient of multiple awards including an NSF CAREER award and holds a PhD from MIT EECS and Harvard Medical School in Computer Science and Biomedical Engineering, and MEng and SB degrees in EECS from MIT.

Richelle Marting, JD, MHSA,RHIA,CPC,CEMC,CPMA

Joshua Preuss

Angela Zigler

Dave Cardelle

Prasanna Ganesan

Brandon Shelton

Brandon Shelton is the Senior Director of the Advanced Analytics Lab at L.A. Care, the country's largest public-option health plan, where he leads teams of Data Scientists and Data Analysts to support the health plan's various enterprise domains with machine learning solutions, program impact assessments, and business intelligence deliverables. The team's contributions towards Payment Integrity savings consistently exceeds $20M per year.

Dr. Michael Menen

Kyle Pankey

Kyle Pankey has over two decades of experience working within the healthcare and payer operations, with over 10 years specifically tied in to the payment integrity space. Kyle lives in Chattanooga, TN and has served as Carelon Subrogation’s growth leader since mid-2022.

Aaron Browder

Aaron Browder is Staff Vice President, Elevance Health and President, Carelon Subrogation, formerly Meridian Resource Company (Meridian), where he and his team are responsible for overseeing the successful implementation and execution of our clients’ end-to-end subrogation programs. With a nearly 20-year career in subrogation, Aaron possesses a deep knowledge of healthcare subrogation. He has held a wide range of management positions throughout his tenure at Meridian, most recently serving as Staff Vice President. Prior to joining Meridian, Aaron gained experience in the financial services and insurance industries with Arthur Andersen, LLP/KPMG, LLP, and Travelers Property Casualty.

Aaron holds a Bachelor of Arts degree from Indiana University and a Master of Business Administration from Butler University. He served on the Board of Directors for the National Association of Subrogation Professionals and has been a national presenter and author on issues related to subrogation.

Matt Monyhan

Creighton Long

Karen Weintraub

With 25 years of data and 20 years of healthcare experience, Ms. Weintraub is currently responsible for the design and development of the company’s healthcare fraud detection software products and services. She provides subject matter expertise on system design and workflow, business rule development, data mining and fraud outlier algorithms as well as SIU policies and procedures. Prior to joining Healthcare Fraud Shield, managed SIUs on various healthcare investigations for all commercial, Medicaid and Medicare business and claims of fraudulent activity. Ms. Weintraub received a BA in Criminal Justice from the University of Delaware and an MA in Criminal Justice from Rutgers University. Ms. Weintraub is a Certified Professional Coder for Payers (CPC-P), a Certified Professional Medical Auditor (CPMA) from the American Academy of Professional Coders, a Certified Dental Coder (CDC) from the American Dental Association, and the founder of the Hamilton, NJ AAPC chapter. She is also an Accredited Healthcare Fraud Investigator (AHFI) from the National Healthcare Anti-Fraud Association (NHCAA). Ms. Weintraub Taught CPT Coding, Fraud & Audits, and Medical Billing, Laws and Ethics and the local community college.

John-Michael Loke

Clay Wilemon

Clay serves as CEO at 4L Data Intelligence™. He has launched over 500 new healthcare brands and holds patents in artificial intelligence and medical technologies. Clay is on the Board of Directors at Octane, a Southern California non-profit economic development organization that has helped hundreds of technology and med-tech companies get started. He a graduate of Vanderbilt University.

Greg Lyon

Greg is a recognized anti-fraud expert with experience in Financial Services and Healthcare Payments that includes serving as Director of Fraud Prevention at United Healthcare. His guiding principle is, “The best way to fight fraud is to prevent it.” Greg is a graduate of Colgate University and is a Certified Financial Planner.

Matt Akromis

Mantha Subrahmanyam

Bob Starman

Michael Stahl

CONFERENCE PACKAGES

- Monday, February 26, 2024 to Thursday, September 12, 2024Healthcare Payers & ProvidersCOMPLIMENTARY PASSAn organization that determine service prices, collect payments, and handle claimsA legal entity, or sub-set of a legal entity, which may contract for the provision of health care

- Monday, February 26, 2024 to Thursday, September 12, 2024Vendors/ Service Providers$5,499Payment Integrity VendorsRevenue Integrity VendorsConsultants

Headline

AMS Intelligent Analytics

Website: http://www.amspredict.com/

Advanced Medical Strategies (AMS) is the premier provider of payment integrity, risk management, and business intelligence solutions to identify and address excessive claims, prevent and recoup overpayments, and effectively manage the risks associated with high-cost claimants and group health underwriting.

PLATINUM PARTNER

Health at Scale, Corp.

Website: https://www.healthatscale.com/

Health at Scale is advancing the next-generation of fraud, waste and abuse detection through real-time context-aware intelligence that allows health plans and third-party administrators to detect and act on inappropriate payments across pre-adjudication and post-pay. Founded by artificial intelligence and clinical faculty from MIT, Harvard, Stanford and U-Michigan, the company offers software solutions and fully-managed technology-enabled services to contain medical costs and reduce administrative burden. Health at Scale’s customers include some of the largest payers and TPAs in the U.S.; with the company’s breakthrough Precision FWA Detection™ technology consistently demonstrating 1-2% incremental reduction in total medical spend in large prospective deployments for Medicare Advantage and Commercially-Insured populations.

For more information please visit healthatscale.com.

Machinify

Website: https://www.machinify.com/

Machinify is transforming healthcare administration with AI. At the core of Machinify is an AI cloud platform that digests and unifies policies, guidelines, and data transforming healthcare administration. Machinify's platform and services power revolutionary applications that interoperate for seamless execution across the healthcare claims lifecycle:

- Machinify Audit: End-to-end system utilizing GenAI and large language models (LLMs) to perform automated coding validation of complex claims.

- Machinify Pay: Software that enforces coding and payment policies against claims and prices claims accurately.

NETWORKING PARTNER

4L Data Intelligence

Website: https://4ldata.com/

4L Data Intelligence™ uses the patented power of Integr8 AI™ to find, fight and prevent fraud, waste, and abuse fast with the revolutionary provider-centric FWA approach. Integr8 AI technology, coupled with our continuously credentialed provider database, detects FWA you can’t see with claim data-centric approaches, solving a challenge every payment integrity platform has today.

The 4L FWA Prevention™ solution rapidly detects and prevents FWA at five points across the claims management workflow including pre pre-payment, pre-payment and post-payment positions. At each point, Integr8 AI dynamically and continuously detects provider behaviors, relationships, and outlier status without the limitations of rules-based and claim data-centric solutions. In short, it enables you to see what providers are doing individually, in relationship with all other providers, and in relationship to all other claims on each-and-every claim submitted.

4L FWA Prevention pre-payment and post-payment detection and prevention results are delivered in four distinct categories. These are:

- Provider Integrity Edits

- Adaptive Claims Edits

- Provider Behavior Analysis

- Provider Schemes Analysis.

For fraud and SIU teams, Integr8 AI detects fraud and collusion schemes you can’t see now, or can’t see fast enough, with claim-centric approaches. Our suite of tools automates continuous near real-time SIU-in-a-box detection and documentation so you can Find, Fight and Prevent Fraud Fast™.

6 Degrees Health

Website: https://www.6degreeshealth.com/

6 Degrees Health is on a mission to reduce the cost of healthcare. We take a service-first approach to our Clean Claim Reviews to ensure accuracy in billing and fair payments. Using our extensive cost containment experience, clinical expertise, and next-generation, purpose-built software, we deliver remarkable savings for health plans. Our proprietary review process leverages CMS and other industry standard guidelines to evaluate every line item and identify billing errors and inconsistencies.

These pre-pay clinical reviews are completed by our team of highly trained and experienced registered nurses to ensure each billed line item is appropriate for reimbursement. This detailed review removes erroneous line items and verifies billing accuracy. Our comprehensive process manages claims during the review stage, as well as through payment and appeals resolution. Our white glove service on appeals allows us to maintain an uphold rate of 97 %, so your savings are secure.

CGI

Website: https://www.cgi.com/us/en-us

Founded in 1976, CGI is among the largest IT and business consulting services firms in the world. We are insights-driven and outcomes-based to help accelerate returns on your investments. Across hundreds of locations worldwide, we provide comprehensive, scalable and sustainable IT and business consulting services that are informed globally and delivered locally.

Data In Formation

Website: https://liberty-source.com/

Liberty Source PBC is a U.S.-based provider of technology-enabled human-in-the-loop data services that help companies realize maximum value from their Artificial Intelligence, Machine Learning, and Business Intelligence investments. Through its flagship DataInFormation brand, the company provides image annotation, data labeling, computer vision calibration, NLP validation, training data curation, prompt engineering, model monitoring / data lineage evaluations, and related data optimization services.

100% of facilities, operations and workforce are US-based to provide the highest level of information security; to minimize time zone issues; and to eliminate challenges arising from different cultural interpretations of data. 80+% of the staff are veterans or members of military families.

Liberty Source has deep domain expertise in a wide range of industry verticals. Extensive capabilities and a nimble culture are key differentiators that enable the company to fulfil even the most rigorous client requirements.

DRG Claims

Website: https://www.drgclaims.com/

DRG Claims Management (DCM) has been offering cost containment solutions to health plans across the United States since 2013. Our services include:

- Hospital Claim Audits (MS/APR DRGs and APC)

- Additional hospital audits

- Cost Outliers

- Readmissions

- Short-Stay/OBS

- Skilled Nursing Facility (PDPM/RUGs) audits

Our models include:

Post-payment Model: Focuses on addressing inaccurate coding and clinical errors retrospectively, maintaining good relationships with providers, and ensuring a smooth refund request process.

Prepayment Model: Preferred by health plans to prevent overpayments, reduce turnaround time, increase provider response, and ensure the audit of out-of-network claims.

Nokomis

Website: https://nokomishealth.com/

Nokomis was founded in 2013 by our current CEO Rich Henriksen to ensure Claim Accountability and make a difference in the healthcare system.

We are still privately owned and therefore only have to answer to our customers - that’s the way we like it.

Through 35 years in healthcare, Rich and his team compiled their deep and broad knowledge to build Nokomis and its proprietary technology, ClaimWise™. This unique technology finds patterns in claim data to identify claims for further review, regardless of dollar amount. Combined, ClaimWise™ and the Nokomis team intelligently select claims for review, finding errors even in claims that look fine at face value.

GOLD PARTNERS

Carelon

Website: https://www.carelon.com/

The health of the healthcare system improves when spending is responsible and accurate. Today, platform technology and advanced analytics are paving the way to make that more efficient and more proactive than ever before. Backed by decades of experience, Carelon’s Payment Integrity solutions bring together breakthrough technology and human expertise to help speed your ability to drive cost savings and value for your stakeholders.

Ceris Health

Website: https://www.ceris.com/

CERIS has 30 years of prepay and post pay claim review and repricing experience with a 97% client retention rate. Our solutions are deep, consistent, and defensible reviews, which make CERIS the partner of choice for health plans, Medicare and Medicaid plans, and third-party administrators. CERIS’ longstanding review services and clinical expertise offer incremental value and are grounded in a sincere dedication to our valued partners. CERIS' mission is to continue to grow and deliver long term Payment Integrity services for our partners and to help them save.

Healthcare Fraud Shield

Website: https://www.hcfraudshield.com/

Healthcare Fraud Shield specializes in fraud, waste, abuse, and error detection and payment integrity for healthcare payers nationally by efficiently stopping claims prior to payment using utilizing post-payment advanced analytics and artificial intelligence insights. We save health plans millions annually incremental to existing pre-payment processes using our unique and proven approach. HCFSPlatform™ offers the combination of targeted rules, artificial intelligence, shared analytics across multiple payers resulting in higher ROI (up to 20:1) compared to other vendors. HCFSPlatform™ software was developed by industry leading healthcare subject matter experts and is a component of over 60+ clients’ including 7 of the 10 largest commercial insurers in the US. Our client satisfaction rating is exceptional with a net promoter score of 84 and client retention rate over 95%. HCFSPlatform™ – is a fully integrated platform consisting of PreShield (prepayment), AIShield (AI), PostShield (post-payment), RxShield (pharmacy analytics), Shared Analytics, QueryShield (ad hoc query and reporting tool), CaseShield (case management), HCFSAudit, and medical record retrieval.

MedReview

Website: https://www.medreview.us/

Headquartered in the financial district of New York City and serving all U.S. states and territories, MedReview has been a leading provider of payment integrity, utilization management and quality surveillance services for more than 40 years. A physician-led organization with a passion for ensuring that health care claims fairly represent the care provided, MedReview provides timely independent hospital billing audits and clinical validation reviews on behalf of health plans, government agencies and Taft-Hartley organizations, saving millions of dollars for its clients each year.

SILVER PARTNER

Sagility

Website: https://sagilityhealth.com/

Sagility is a U.S.-based, tech-enabled healthcare business process management company that supports payers, providers, and their partners to deliver best-in-class operations, enhance the member and provider experience, improve the quality of care and promote health equity all while delivering cost-effective healthcare financial and clinical outcomes.

Sagility Technologies uses a holistic consulting approach to identify the root causes of healthcare payer and provider pain points, analyze the issues, and provide a complete solution that encompasses people, process, and technology platform improvements. Equipped with a strategic solutions mindset, our core focus is on what most benefits the client. Combining healthcare operations and technology experience with advanced UI, UX, and analytics expertise, we develop and deploy customized solutions for our client’s business. Additionally, with our extensive global resources and facilities, we provide the best service/price ratio for any service outsourcing needs.

EXHIBITOR

AMPS

Website: https://www.amps.com/health-plans

ClaimInsight by AMPS is a cutting-edge claims editing solution, designed to deliver exceptional savings and innovative Payment Integrity.

In today’s PI landscape, payers are demanding more from their prepay claims editing solutions. Advanced Medical Payment Solutions (AMPS) is proud to introduce ClaimInsight, a groundbreaking platform designed to exceed these expectations. ClaimInsight offers exceptional value by providing substantial Medical Spend savings while ensuring a more competitive contingency rate compared to current market options.

Developed by industry veterans with over 40 years of payment integrity experience, ClaimInsight features a state-of-the-art Payment Policy library and an advanced rules engine. This combination delivers automated, precise claim editing with rapid execution of policies and rules. Our library includes industry-standard edits, designed to minimize provider abrasion while optimizing savings.

ClaimInsight goes beyond traditional solutions with our unique Medical Bill Review (MBR) service. This service includes a meticulous line-by-line review of high-dollar, complex claims by a Medical Director, ensuring thorough payment accuracy and preventing overpayments on claims ranging from $2 to $2 million.

Clients using ClaimInsight have achieved impressive results, including reduced annual medical spend and lower Payment Integrity overhead. Even if you already have a claims editing solution in place, ClaimInsight provides additional savings on top of them, with an average savings of ~$5M per 100K members.

Here’s why ClaimInsight stands out:

- A comprehensive, industry-standard prepay claim editing library that delivers significant savings.

- A modern, powerful rules engine for faster, more efficient processing.

- The best value in the industry with the lowest contingency cost per medical dollar saved.

- An exclusive Medical Bill Review (MBR) service unique to AMPS.

ClaimInsight represents a fresh, superior offering in claims editing, designed to deliver unmatched value and efficiency.

Apixio

Website: https://www.apixio.com/

Apixio, formerly ClaimLogiq, is the Connected Care Platform at the intersection of health plans and providers. Our AI technology and flexible services power risk adjustment, payment integrity, and care delivery programs using centralized patient health profiles, data-driven insights, and seamless workflows. By combining ClaimLogiq and the Apixio technology ecosystem, healthcare organizations can streamline operations, ensure accurate payment, and uncover critical patient insights—building a resilient foundation for success as the industry moves toward value-based reimbursement models. Visit apixio.com to learn more.

Intellivo

Website: https://intellivo.com/

Intellivo provides technology-enabled pre-bill and post-pay TPL identification and full recovery solutions for complex claims that improve payment accuracy, maximize savings, increase recovery speed, and provide a positive experience for providers and patients and for health plans and plan members. Intellivo illuminates the full story behind healthcare costs sparking opportunities for measurable savings and returns and empowers providers, health plans and consumers to take control of healthcare costs. For more information, please visit intellivo.com.

Penstock Group

Website: https://www.penstockgroup.com/

Penstock is a service partner and SaaS builder for forward-thinking health plans and providers, empowering recovery, audit and regulatory teams to get accuracy right from the start—when it matters most. Our mission is to create lasting systemic change that removes wasted spend from our healthcare system, returning dollars to payers, lowering the cost of care and improving access for all.

Penstock is powered by industry veterans who are some of the most sought-after payment integrity and regulatory experts in the industry. Our business model is rooted in transparency and the drive to reinstate true integrity in payment integrity—even if it defies traditional business sense.

Our audit workflow SaaS platform, ClearBridge gives health plans the tools and insights they need to identify overpayments, correct them and implement their own edits with ease, ensuring correct payments and mitigating future discrepancies.

When you partner with Penstock, you reclaim time and control with an end-to-end partnership that beautifully and seamlessly connects human and machine intelligence—to prevent recurring issues at the source.

Slingshot Advocacy

Website: https://www.slingshotml.com/

Slingshot’s AI models analyze medical records to clinically validate diagnoses driving payment. Our models run in minutes to fit into pre or post pay flows. Slingshot’s solutions allow payment integrity teams to increase the number of records reviewed, improve their findings rate and speed up reviews.

Accredited by:

AAPC

Website: https://www.aapc.com/medical-coding-education/

Health care professionals are obligated to stay current in their profession. This includes continuing education in their respective discipline as well as keeping up with the latest medical coding updates, compliance rules, and government regulations. AAPC supports its members to maintain a distinctive edge in their health care career by providing a wide variety of topics and subject matter delivered live or on demand, in classrooms or over the web.

PARTNER WITH US

Based on your objectives, we can create bespoke packages designed specifically for you – from presenting your expertise on the main stage, to hosting a private dinner. You can partner with us showcase your brand and make valuable new connections. Opportunities predominantly lie in 3 main categories: Thought Leadership, Branding & Networking.

To discuss your objectives and partnership opportunities please contact Harry Ludbrook, Sales Director [email protected]

Interested in a media partnership?

We'd love to hear from you and how we can support one another to connect with the industry. Contact Jodie Purser, Marketing Manager, [email protected]

PARTNER WITH US

Based on your objectives, we can create bespoke packages designed specifically for you. Opportunities predominantly lie in 3 main categories: Thought Leadership, Branding, and Networking.

Interested in a media partnership?

We'd love to hear from you and how we can support one another to connect with the industry. Contact [email protected]

Delivering scalable and flexible solutions which ensure accuracy and integrity of claims

The Healthcare Payments & Revenue Integrity Congress is the only summit focused on addressing healthcare waste and ensuring that claims are paid correctly, reflecting current healthcare needs. You will join key decision-makers, within health insurers and providers, who are responsible for payment and revenue integrity, value-based payment, and networking relations.

At a time when both payers and providers are evaluating and streamlining internal payment and revenue integrity processes, this networking conference has been established to breakdown silos, by promoting discussion between clinical, coding, revenue cycle and payment departments to facilitate the development of efficient, value-based healthcare systems.

Venue

Luxor Hotel & Casino, 3900 S Las Vegas Blvd, Las Vegas, NV 89119, United States

We're excited to welcome you face-to-face in Las Vegas at the Luxor Hotel & Casino for the Healthcare Payment & Revenue Integrity Summit West!

To stay at a discounted rate, you can use the link here.

About Kisaco Research

Kisaco Research produces, designs and hosts B2B industry conferences, exhibitions and communities – focused on a specialized selection of topic areas.

Meet industry peers that will help build a career-changing network for life.

Learn from the mistakes of your peers as much as their successes—ambitious industry stalwarts who are happy to share not just what has made them successful so far but also their plans for future proofing their companies.

Note down the inspired insight that will form the foundation for future strategies and roadmaps, both at our events and through our online communities.

Invest both in your company growth and your own personal development by signing up to one of our events and get started.

We'd love to hear from you.

Contact us at +44 (0)20 3696 2920 and email [email protected], or let us know what subject area you're interested in below.